Strategy Design Sprint

By Alen Faljic

Design sprints have become enormously popular. They are a staple offering for all design agencies and in-house design teams. I think a big part of the design sprint’s success is due to its elegant and easy-to-understand format. That’s exactly what design needed.

Design is hard to explain. And when something is hard to understand, it is hard to adopt (and sell). It turns out that sprints were a great packaging that helped us better explain design to the business community, which led to its greater adoption.

As a business designer, I started exploring how we could apply this great format to designing business topics. I was particularly interested in the topic of business strategy because most designers crave more strategic work. So, finding a format that will open the door for such work seemed like a worthy project.

But designing a strategy is complex and takes time, right? How could it fit into a sprint format? Well, designing a strategy might feel like a big, imposing topic that takes months to design and implement, but the core strategic ideas can actually be designed and tested in just a few days.

After some exploration and a few iterations, I landed on the Strategy Design Sprint format, consisting of a research and design phase. In this blog post, I only cover the content perspective of the Strategy Sprint. For the process and mindset perspective, I assume you are familiar with the Design Sprint book.

Please see this blog post as the first draft of something we can design together. It's an open-source format, which you can adapt, change, and sell to your clients. You can combine the guide with the ready-to-use sprint template in Miro. It is based on my consulting experience of working with startups and Fortune 500 companies on strategic projects.

I hope you take it as an inspiration and make it your own. And once you do, I would love to hear back from you. If we all share feedback, we can integrate the best improvements and share them further with the design community. To do that, just reply under the comments below.

But wait...

What exactly is strategy?

Strategy is one of the most common misused words in business and design. Some people use it for a high-level approach to things (“we need a different strategy for attracting talent”) and some use it as a synonym for a structured approach (“let’s strategically approach this and first prepare a plan”). In the business context, these uses are simply wrong because strategy has a very specific definition.

“Strategy is choosing what to do and what not to do. ”

In the most simple terms, strategy is making hard decisions about what we will do and what we will not do. It requires making hard trade-off decisions. These are the choices that require us to either do X or Y. We can’t do both. Let me explain with a couple of examples.

Size and speed are typical tradeoffs in car design. Cars that are bigger are heavier. That makes them slower but much more spacious and comfortable. On the other side, sports cars are usually small and light, allowing for fast acceleration and high top speeds. For example, McLaren’s Senna is a supercar that costs one million dollars but doesn’t even have air conditioning to save weight and improve the car's performance.

Another good example is the competing strategies of Google and Apple. Google’s philosophy is software-first while Apple’s is hardware-first. Google’s software is designed to work well with many different platforms while Apple’s software is designed to work only with Apple hardware. The tradeoff here is compatibility (Google) versus quality control (Apple). Google’s compatibility comes at the expense of controlling the user experience and vice versa.

Now that we have the same understanding of strategy, let’s have a look at the Strategy Design Sprint format. You can combine content from this guide with the ready-to-use sprint template in Miro.

Week 0 - Business Empathy

Activity 1: Competitive Arena & Recruiting

Week 1 - Strategy Design Sprint

Monday: Prepare Strategy Canvas

Week 0: Business Empathy

Prior to running the sprint, we have to conduct fundamental business research, which will set us up for a successful Strategy Design Sprint.

Activity 1

Competitive Arena & Recruiting

First of all, we need to get familiar with the competitive landscape in which we will design a strategy. Who are direct, indirect, and potential competitors that we compete with?

“We need to understand the options that customers have when solving a certain problem. To do that, we can use a simple tool called competitive arena and just list out all the relevant players. ”

Just the mere act of listing out competitors leads to many interesting realizations. Let’s say that you are working for a car manufacturer. What is the context here? Car industry? Other car manufacturers? Not necessarily. When customers want to get from point A to B, they are not thinking about cars. They are thinking about solutions. And these solutions include airlines, trains, car-sharing services, public transportation, etc. Correctly understanding the advantages and disadvantages of cars vis-a-vis other options improves our empathy for the problem space and leads us to much better decisions.

Competitive Arena helps us define who we compete with.

To create your competitive arena, you have to define the following:

Customer Goal

What are customers trying to achieve? Uncovers problem space, not products. Use Jobs to be Done framework to define your customer relevant goal

Direct Competitors

Who are we directly competing with? Who offers the same product or service?

Indirect Competitors

Who is working on the same customer goal but offering a different product? Think beyond the existing industry.

Potential Competitors

Who is not competing in the arena yet but could be soon? Again, think beyond the existing industry.

Sometimes, we have to prepare a few competitive arenas to fully understand the situation. For example, if our company is working on several customer goals, we would have to prepare one arena for each problem. However, usually one or two arenas are enough. We just need to define the focus point (e.g. most important problem that your company solves) and for whom.

This will also uncover who you should invite to the testing on Thursday next week so you can also start with the recruiting.

Activity 2

Value Chain

To design a viable strategy, we need to understand how products and services get made in arenas. Value chains essentially show how raw materials are turned into end products. We list all suppliers, distributors, and retailers required for the creation and delivery of products.

But why is that important?

“Understanding the value chain can help us change how our products and services are made and through that change the strategy and company’s value proposition. ”

For example, VanMoof has created a completely new value proposition by changing its value chain in the bike industry. Traditionally, bikes are made by assembling bike parts designed by a multitude of companies. One company creates gears, another one lights, third bike paddles, etc. VanMoof has decided to design all bike parts in house, which unlocked many new cool features such as integrated bike lock, light, and electric battery, making the bike virtually unstealable.

VanMoof designs all bike parts in house, which enabled the company to create a unique value proposition and a defendable strategy.

Define the value chain with these three steps:

Start with the generic value chain. In almost every industry, you have suppliers, “makers”, distributors, and point of sale. Adapt the generic version but keep it on the right level with 4-8 parts of the chain.

List all the relevant players. Which companies are manufacturers, logistics companies, retailers, customers, etc. What are their strengths and weaknesses?

Analyze your position. In what parts of the value chain is your company active? What is being outsourced?

Activity 3

Cost Drivers

Analyzing cost drivers may seem like a minor part but it is a super important step. We need to understand the costs associated with creating a product and running a business. Strategy is all about choosing what we will invest in (time, resources, money) and what we will not invest in. So, cost drivers are the lego blocks of our strategy.

We need to identify the biggest cost drivers (what contributes to our costs). Even better if we can estimate their relative size (e.g. steel makes up roughly 10-15% of the car cost). This gives us a better understanding of their relative importance.

To identify cost drivers:

Go through annual reports of companies in the arena. Annual reports are only available for public companies so your safest bets are the largest corporations. Just search for <annual report + company name>. In the annual report, search for an Income Statement (also called Profit and Loss Statement or Consolidated Statement of Operations). In there you can find some of the biggest cost categories by using the find function and looking for “costs”.

Talk to an industry/arena expert and ask them about the main cost drivers.

Sometimes you can accurately estimate cost drivers from a customer perspective. For example, does Volvo invest more in car safety than Citroen?

If you have experience in an arena, you may already know the biggest cost drivers. Just ask yourself where the company's resources, time, and money are going.

“Remember that your client or senior colleagues may already have most of this knowledge. Instead of spending days preparing a Competitive Arena or Value Chain, just talk to people who have been in the arena for a long time. This is an important shortcut that can help you gain business empathy for an arena in just a few days.”

Week 1: Strategy Design Sprint

Now we have all the building blocks necessary to design the strategy: competitive arena, value chain, and cost drivers. So, let’s design and test the strategy in 5 days.

Monday

Prepare Strategy Canvas

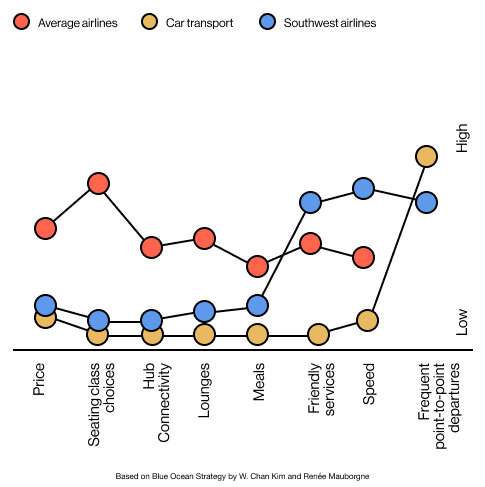

Your most important tool of the second week is the Strategy Canvas. The canvas shows us how different strategic groups compete in our arena. It shows what they invest in and how much.

The canvas consists of 2 axes. At the bottom, there are so-called competing factors. Competing factors are things companies invest in (i.e. your cost drivers that we identified in week 0). Usually, we have no more than 8-12 of these factors. If you have more, try to group them further. And on the y-axis, we measure the offering level. So, how much does a strategic group invest in this particular factor?

The Strategic Canvas for long-distance travel from the perspective of Southwest Airlines. Its customer goal, helping customer get the from point A to B fast, is competing with cars and other airlines. This was status quo before Southwest Airlines decided on their strategy.

Together with your team or client draw the status quo in your arena:

Define strategic activities for an arena or industry. Use your learnings from the Cost Drivers research.

Identify the most relevant strategic groups. To identify groups, you can think of the biggest companies in an industry and how they compete. For example, Lufthansa would be an example of a premium airline while Southwest Airlines would represent low-cost airlines. They illustrate two strategic groups in the airline industry (premium vs low-cost airlines).

Draw strategic lines. The best way to draw lines is by imagining the biggest player in each strategic group and simply drawing a line for them. The line will represent the whole group. Keep in mind that the line doesn’t have to be absolutely correct but relatively (vis-a-vis competitors). In this step, we can also draw the current strategic line of our product or business.

Have a look at other examples of Strategy Canvases to get the feeling for how it needs to look like.

Tuesday

Identifying Trade-offs

Today, we are looking for 3 to 5 most important trade-offs. So, we are looking for investments that have the largest potential to create unique value on the market. Let's have a look at two examples.

The first one comes from digital-only banks like Revolut and N26. They completely eliminated bank retail presence. This means they can cut out investments in retail and invest more towards making a better digital bank experience as well as offering cheaper bank services. The trade-off, in this case, is money invested in the retail presence versus the price of a product.

Let’s take another example from the hotel industry. If we were building a hotel for business travelers, your trade-off investments could be:

City-center location but small rooms vs suburban area and big room

Small room but great bed vs big room but a basic bed

Check-in desk vs great gym

Now, we can turn these trade-offs into customer scenarios. What should we invest in and what will we cut out as a result? These scenarios can be simply hand drawn like the one below. They can be wireframes if we are testing digital products. They can be landing pages if we are testing pricing models. It really depends on what the trade-off is. If you are running out of ideas for experiments, check out the book Testing Business Ideas.

A sketch prototype that challenges customers to make a trade-off decision (big room but not-so-great bed or small rom but great bed).

As you have seen with both examples above, strategy is tightly connected to your target group. Investments in competing factors highly depend on who we are targeting. For example, digital banks are clearly targeting younger generations who don’t value banks’ retail presence. In this stage, you can choose which trade-offs you will show to which participant on Thursday.

Wednesday

Create Prototypes & Research prep

It’s time to brainstorm customer-facing concepts that will help us test the strategy. We need to find out how certain investment decisions will materialize from the customer perspective. For example, the bank with no retail presence but better UX. Once we have a long list of ideas and potential prototypes, we need to decide which ones to take into testing. You can find more details about the voting process in the Design Sprint book.

Today, we also need to prepare the interview discussion guide and process for running interviews. There has been plenty written about that here and in the book.

Thursday

Testing Strategy

Today, we will conduct 5 in-depth interviews with people from our target market.

Spend the first half of the interview learning about them because this will help you understand their reactions to your prototypes. In the second half, show your prototypes and get feedback.

“It is very important that we frame these prototypes as scenarios with opposite options A and B and ask interviewees to choose just one option. Choosing one option is the essence of trade-off decision making! ”

When you present your scenarios, you have to talk about the advantages and disadvantages. We need to give both scenarios a chance to win. If we only talk positively about one option and negatively about the second one, our results will be biased. Furthermore, it is very important to hear their “why” behind answers. In most cases, why they choose a certain answer will help us know how to take this idea further.

In certain cases, we can also interview crucial stakeholders from your value chain or arena. For example, if your idea is to design all bike parts in house, like VanMoof, you may want to speak to potential production and assembly partners. This brings out the feasibility perspective. In reality, it is usually much harder to recruit such interviewees in the given timeframe so this phase could happen after the sprint.

Friday

Wrapping up results

At the end of the week, we wrap up the results. First of all, we need to go back and cross-check all our learnings. Take a (digital) whiteboard and lay out everything you have learned so far.

Secondly, look for patterns. What are the emerging themes in your research? Group data points from various parts of your research into meaningful content buckets. For example, you learned that hotels invest 5% of their annual budget in check-in counters and all your interviewees said that they prefer digital check-in. These two data points can be grouped together under a bucket called “Check-in”. Repeat this process until you feel you’ve exhausted all the big topics.

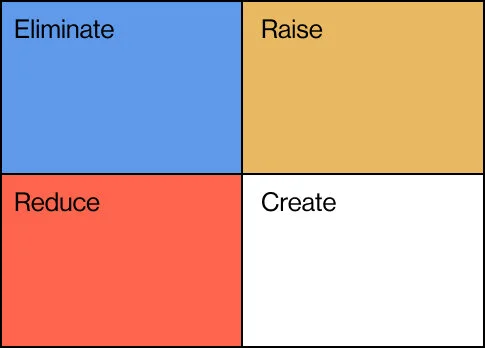

Conclude by drawing a line for your business or product in the Strategy Canvas. A great tool for drawing the line is ERRC grid.

Take all the competing factors that you have defined on Monday and ask four questions:

Which factors are no longer important and can be eliminated?

Which factors can be reduced well below the industry average?

Which factors should be raised above the industry average?

What factors can be created? What new features/investments can we introduce to the market that customers value?

Once we answer these questions, we can plot the factors on the canvas. The line shows where we are cutting investments and where we are raising/keeping investments. The litmus test for a good strategy is a divergent line. So, your line has to be clearly different from already existing strategic groups and their lines.

Let’s imagine that Southwest Airlines has run the experiment and one of the trade-offs they tested was ticket price and meals. They figured out that customers are actually willing to not get food on board if that meant cheaper tickets. For Southwest Airlines, this means they didn’t have to invest in food preparation anymore.

In the canvas below, this is shown with a lower level of investment in meals compared to average airlines. Furthermore, imagine that the sprint showed us that customers are also willing to sacrifice seating class choice, hub connectivity, and lounges for cheaper tickets.

All these cost savings mean that Southwest Airlines can invest in something else. Something completely novel in the industry: frequent point-to-point departures. So, customers who wanted to get from one smaller city to another would get there faster.

Average airlines would always first fly to their central hubs (Atlanta, Paris, Tokyo, Frankfurt, etc.) and out of there to your end destination. So, what would normally take two flights would only be one with Southwest Airlines.

After testing, we can draw our strategic line. A blue line shows strategic choices for Southwest Airlines.

Remember how we defined strategy at the beginning? The strategy is choosing what to do and what not to do. So, we can also show the results of our sprint with a simple Do and Don’ts visualization, which clearly show what we will do and will not do.

Finally, we can accompany the canvas with strong business and customer rationale (add customer quotes, business research, etc.).

It’s your turn.

The Strategy Design Sprint is a widely applicable format. It can be applied to product strategies as well as company-level strategies. From my experience, it works well with big corporations and small startups. Every company regardless of its size and industry is making trade-off choices. Using this approach, we can really elevate the design to a strategic level and have more impact.

I hope that you find this prototype of Strategy Design Sprint attractive enough to try it out. Our Strategy Design Sprint template in Miro might come in handy too. And if you do end up trying it out, I am happy to help. If you have any questions, just drop them in the comment section below.